Our Approach Offers Multiple Advantages

You invest in portfolios constructed entirely of exchange traded funds (ETFs). We vet ETFs using our proprietary Zacks ETF Rank, which reflects fundamental and technical factors, plus issues that may impact the underlying industry or asset class. Our experienced team actively manages your portfolio to seek superior performance. You get all of that for a fee that’s up to 75% less than what typical advisors charge.*

Zacks Advantage Proprietary Forecast Model

Each ZacksAdvantage risk delineated portfolio (ranging from moderate to aggressive) is actively managed and evaluated on a monthly basis in accordance with our proprietary adaptive 10-year forecasting model. The Zacks Advantage forecasting approach is drawn from academic and proprietary research to create a broadly diversified portfolio of ETFs pursuant to an investor’s needs and risk tolerance with our quantitative and qualitative models, investment insight and 40+ years of investment management experience.

Zacks Advantage Portfolio Selection

Not all ETFs are created equal — our quantitative model seeks to select only the best performing ETFs in every asset category. The foundation of our ETF selection process is the proprietary Zacks Investment Research ETF Ranking System, which factors in fundamental, technical and cost considerations.

Not all ETFs are created equal — our quantitative model seeks to select only the best performing ETFs in every asset category. The foundation of our ETF selection process is the proprietary Zacks Investment Research ETF Ranking System, which factors in fundamental, technical and cost considerations.

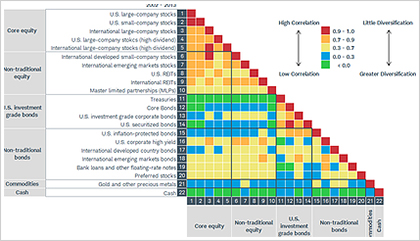

Zacks Advantage Portfolio Allocation

Asset allocation forms the core of the ZacksAdvantage investment philosophy. By providing a framework to deploy capital over a mix of investments, asset allocation allows investors to diversify holdings and mitigate downside risk.

The ZacksAdvantage asset allocation process is based on mean variance optimization — seeking out the highest level of expected return for a given level of risk. The investment committee uses research driven financial analysis in an effort to optimize the allocation of each group, and the distribution of each asset class within that group.

Growth

- US large-company stocks

- US small-company stocks

- International developed large-company stocks

- International developed small-company stocks

- International emerging markets stocks

Growth and Income

- US large-company stocks (high dividend)

- International developed large-company stocks (high dividend)

- Master limited partnerships (MLPs)

Income

- US investment grade corporate bonds

- US corporate high-yield bonds

- US securitized bonds

- International emerging markets bonds

- Preferred stocks

- Bank loans & other floating-rate notes

Inflation

- US inflation protected bonds

- US REITs

- International REITs

Defensive Assets

- Cash

- Treasuries

- Gold & other precious metals

- International developed country bonds

Losses Are Harvested Automatically To Help Offset Taxes On Gains.

One of the most effective tools for offsetting investment-related taxes is tax-loss harvesting: selling a security that has lost value to offset the gain on another security. The sold security is then replaced with a similar security to keep your portfolio allocation on target.

Tax-loss harvesting can be a complicated and time-consuming strategy, and in the past has been accessible only to the wealthiest investors. With a Zacks Advantage account of $50,000 or more, losses are harvested automatically.

Zacks Advantage Makes The Complex Simple

Asset allocation has evolved beyond stocks, bonds, and cash to include a bewildering array of asset classes. Now, the average investor has access to a highly diversified, cost effective and tax efficient portfolio through the use of sophisticated analytics and ETFs.

Zacks Advantage employs all these tools and strategies to pursue enhanced performance with reduced risk. Our goal is to provide you with an actively managed portfolio built to match your financial objectives.

1 75% lower fees based on a 2015 Cerulli Gobal analytics study which reported an average 2014 annual explicit client fee for sub-advisory separate accounts of 1.65% for an average traditional advisor, versus Zacks Advantage’s fee of 0.35% for portfolios of $250,000 or more.