Can Policymakers Handle Four Economic Issues at Once?

May 26th, 2023 | Posted in InvestingCan U.S. Policymakers Navigate Four Issues at Once?

At the beginning of the year, U.S. policymakers were dealing with a tangible dilemma. They needed to wage the fight against inflation without damaging economic growth too much. In the few months since, the dilemma turned into a “trilemma,” as the U.S. experienced two of the biggest bank failures in history. With sustained pressure on regional banks and jitters about the health of the banking system, a financial crisis was added to the list of issues that needed addressing.1

Now there’s a fourth issue. With the U.S. staring down an alleged June 1 “X-date” for running out of the funds needed to meet all government obligations, the “trilemma” has all of a sudden become four problems policymakers need to address at once. We break down each of these issues below.

Let’s start with economic growth. To date, the monetary policy tightening cycle has had some measurable impact on overall growth, but U.S. consumers have helped ward off a recession. Pandemic stimulus measures resulted in a surge of savings and improvements to household balance sheets, which supported spending over the past couple of years. But there’s also been the strong labor market, which has bolstered wages and resulted in the lowest unemployment rate in a generation. High levels of employment support high levels of spending.

Positioning your investments for a volatile market.

“Don’t put all your eggs in one basket.” It’s a classic proverb, and for good reasons. Diversifying your portfolio is one the most basic pieces of investing advice—but unfortunately, it’s also advice that too many investors ignore.

Zacks Advantage would like to help you ensure that your investments are properly diversified so that you can avoid the risks of over-concentration in any particular asset class. That’s why we’re offering our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

Act now to get the basics of diversification, including:

- Why the average investor’s returns lag behind almost every investment category

- 4 myths of a diversified portfolio

- How to create a truly well-diversified portfolio

Learn more with our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

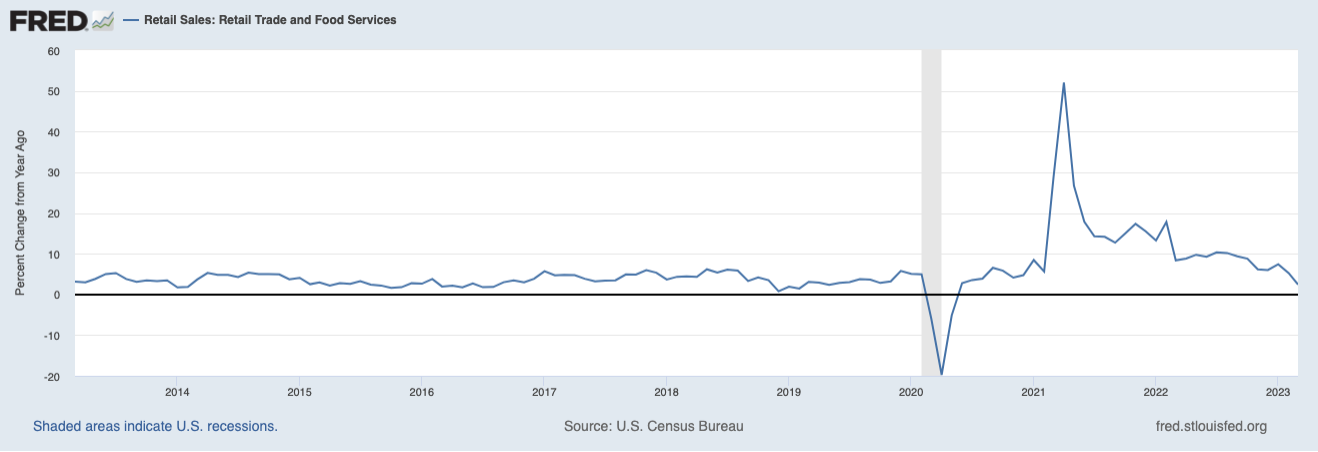

But signs are starting to emerge that the consumer is pulling back. As seen in the chart below on retail sales, peak spending as a result of fiscal stimulus was years ago and has been trending lower ever since.

The issues in the banking sector, discussed below, may also drive a change in consumer behavior. A strong jobs market and sturdy wage growth may give consumers the ability to spend, but bank/economic/growth concerns could change whether or not they choose to spend. In the realm of inflation and spending decisions, consumer sentiment matters.

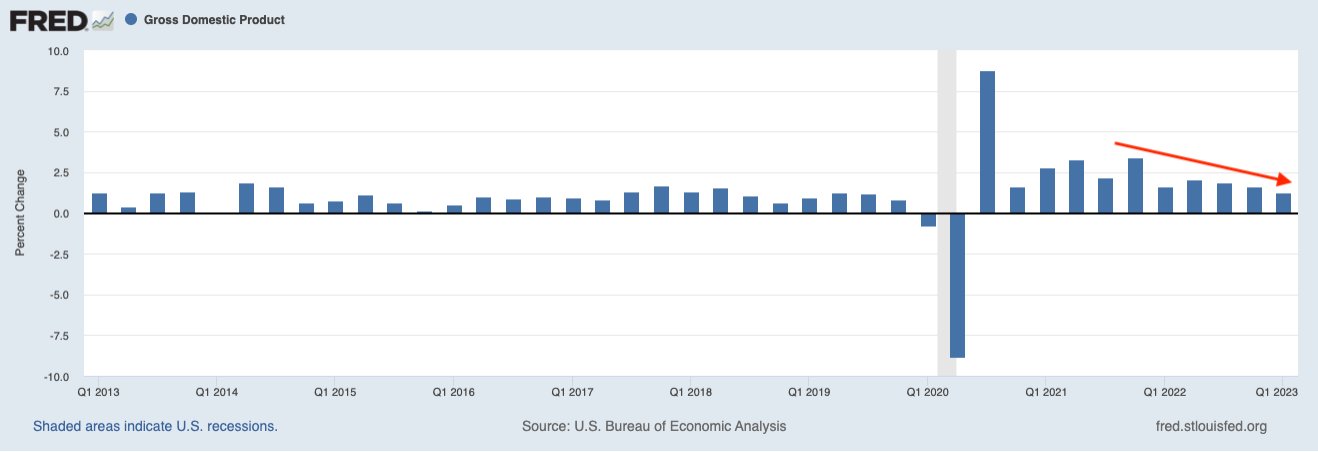

The end result is that U.S. GDP growth has been tapering off from the stronger rates posted in the years following the pandemic, as seen in the chart below.

U.S. GDP Growth Has Been Slowing

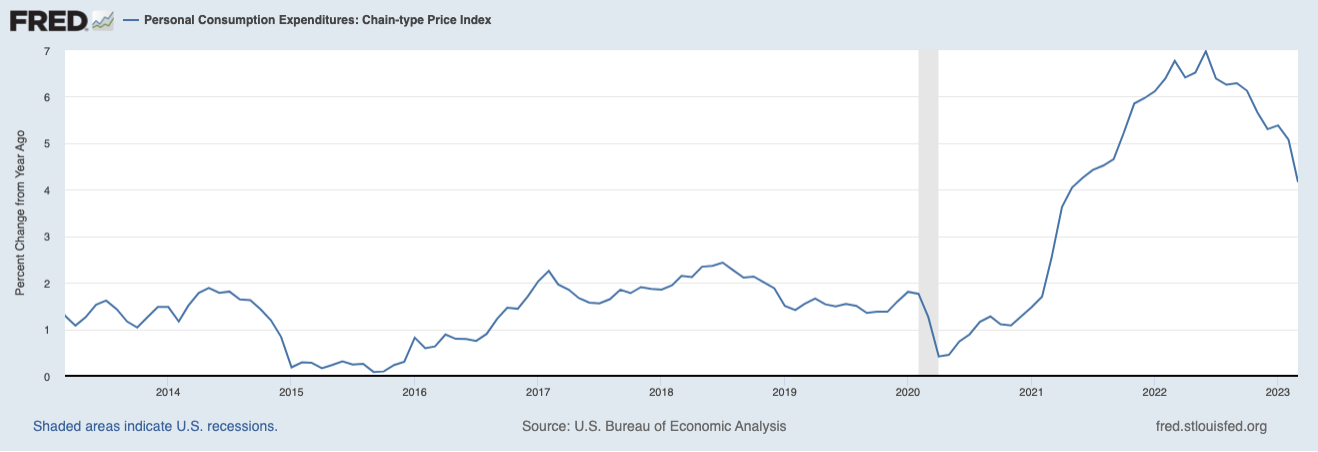

The second issue is inflation, which is still well above the Federal Reserve’s 2% target. The latest inflation reading from the Bureau of Labor Statistics showed the consumer price index (CPI) measure of inflation rising by 4.9% year-over-year in April. This inflation print marks a solid improvement from the 9.1% peak reached in June 2022, but still signals that there is a long way to go before the Fed’s goal is met.

Inflation is Trending in the Right Direction, But Is Still Elevated

Much has been made of the Fed’s possible decision to pause rate hikes going forward in 2023. But the question now becomes how long they will hold rates at these higher levels before easing monetary policy again. The market seems to expect that rate cuts will come sometime this year, but the potential stickiness of inflation may imply that rates remain higher for longer. The uncertainty around what measures policymakers need to take is what makes this issue important for markets.

The third issue is financial stability. The major failures of Silicon Valley Bank and Signature Bank New York drove uncertainty in the markets and amongst depositors, particularly those at regional banks. The rippling effects that remain in the regional bank sector make it clear that the issue is not yet fully resolved, even if it is apparent to many that the overall U.S. banking sector is in good health.

Policymakers have responded by making depositors at all failed institutions whole, while providing emergency lending facilities for other banks that may face funding issues. The Fed and FDIC’s willingness to intervene, while meant to reassure markets, in some cases gives the impression that something bigger is wrong – which can make the problem worse.

It’s clear that policymakers have not completely resolved this issue. Investor concerns about the regional bank crisis – and its potential for economic disruption – could be entering a new chapter with PacWest Bancorp. In a securities filing in early May, the bank reported losing 9.5% of its total deposits, most of which occurred on May 4 and 5 when news reports hinted at a potential sale. The stock has been pummeled.

For PacWest and other regional bank names, bond markets are demanding higher yields for regional bank bonds, and short sellers are eager to identify the next possible shoe to drop in the sector. These factors are adding additional pressure, which can easily rattle depositors and result in more failures.

The fourth and final issue is one the country has experienced many times before, especially in recent history: a debt ceiling standoff and the potential for missing payments on government obligations.

In this latest installment of the debt ceiling issue, the Treasury Department has warned that the U.S. could begin missing payments as early as June 1. Other forecasts suggest the U.S. government may have until early August. It is unclear which payments would go unpaid first, but there’s a strong indication that the Treasury could prioritize debt payments over obligations like government wages, VA benefits, Social Security, and the host of other payments owed – akin to a government shutdown, which has happened before.

Being late on—or missing—a Social Security payment or a child tax credit payment is not good, but it is also not the same thing as missing a principal payment and/or interest payment on a Treasury bond. Consider that delaying a Medicare payment is an unfortunate lapse in a government entitlement program while missing an interest payment on a bond is “default” in the true sense of the word. The latter is where the economic consequences lie, which begs the question of whether policymakers can arrive at a deal sooner than later.

Bottom Line for Investors

Can policymakers navigate each of these four issues at the same time? The answer remains to be seen, but the equity markets may be providing clues. Since October 2022, equities have been in rally mode, even with the bank failures and regional bank pressure that followed. As debt ceiling talks have occurred but provided no meaningful breakthroughs, stocks have essentially shown little to no negative response. Could the U.S. economy manage to see inflation fall; for growth to teeter but not break; for bank stress to fade; and for a deal on the debt ceiling to arrive? We think there’s a distinct possibility the answer could be yes.

For most investors, the key to getting where they need to go over the long term is to own a diversified portfolio of stocks and/or ETFs. In fact, “diversify your portfolio” is one the most basic pieces of investing advice. Sadly, in our experience many investors still put all (or most) of their eggs in one basket.

At Zacks Advantage, we strive to help every investor properly allocate their assets. In fact, we’ve put together a helpful guide to help you understand the basics of portfolio diversification, including:

- 4 myths of a properly diversified portfolio

- Why the average investor’s returns trail almost every other investment category

- How to create a truly well-diversified portfolio

Get our free guide, Is Your Investment Portfolio Actually Well-Diversified? 6, to learn how to create a truly diversified portfolio.

*This rating was awarded by The Robo Report on 4/1/2023 in respect of the period 1/1/2023 to 4/1/2023. We do not compensate The Robo Report to obtain this rating. However, we pay compensation to the Robo Report to use their logo in connection with advertising this rating.

© 2023 Zacks Advantage | Privacy Policy | Unsubscribe

2 Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

3 Fred Economic Data. May 16, 2023.

4 Fred Economic Data. April 27, 2023.

5 Fred Economic Data. April 28, 2023.

6 Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Robo investments are subject to some unique risks, including, but not limited to, the fact that investment decisions are made by algorithms based on investors’ answers to questions, there is a lack of human involvement, and there is the possibility that the software may not always perform exactly as intended or disclosed. Such investment programs are only suitable for investors who can bear the risk of a complete loss of their investments.

The S&P GSCI is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The index is designed to be investable by including the most liquid commodity futures, and provides diversification with low correlations to other asset classes. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. Index composition is reviewed on an annual basis in December. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Zacks Investment Management 10 S. Riverside Plaza, Suite 1600 Chicago IL 60606-3830

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.