A Potential Headwind for Big Tech is Looming

August 4th, 2023 | Posted in InvestingA Potential Headwind for Big Tech That No One is Talking About

The U.S. Technology sector has delivered blistering returns so far in 2023. Through the end of June, the sector was up +39%, more than double the S&P 500’s 16.2% year-to-date return. Investors should recall, however, that these positive returns follow a dismal 2022, when Technology disproportionately sold off during the period of rising interest rates and the bear market.1

The turnaround has been welcomed, and investors are largely pointing to two tailwinds supporting the strong rally in the new year.

Are Your Investments Really as Diversified as They Should Be?

“Don’t put all your eggs in one basket.” It’s a classic proverb, and for good reasons. Diversifying your portfolio is one the most basic pieces of investing advice—but unfortunately, it’s also advice that too many investors ignore.

Zacks Advantage would like to help you ensure that your investments are properly diversified so that you can avoid the risks of over-concentration in any particular asset class. That’s why we’re offering our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

Act now to get the basics of diversification, including:

- Why the average investor’s returns lag behind almost every investment category

- 4 myths of a diversified portfolio

- How to create a truly well-diversified portfolio

Learn more with our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

The first tailwind is the excitement surrounding Artificial Intelligence. Google’s CEO, Sundar Pichai, referred to AI as a technology “as important—or more important—than fire and electricity.” This may seem like hyperbole coming from a key stakeholder in AI’s future, but when compared to other comments about AI from thought leaders across the economy, it is clear that AI may indeed be the next Internet or iPhone moment.

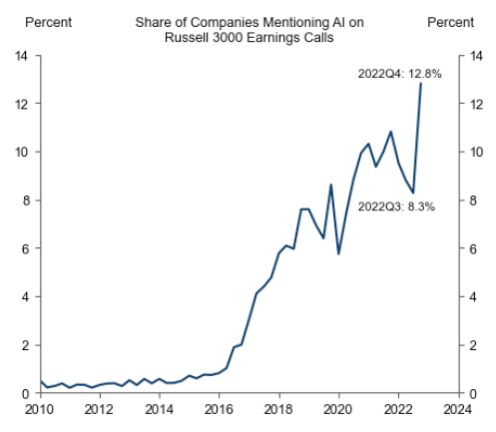

Companies are announcing one after the other how they plan to develop AI tools or implement them within business models to raise productivity. Enthusiasm is making its way into earnings calls as well. As seen below, the share of Russell 3000 index companies that mentioned AI on earnings calls has soared over the past six months:

According to Goldman Sachs, generative AI could raise labor productivity growth by 1.5% over 10 years while increasing annual global GDP by 7+%. In dollar terms, this means AI could create $7 trillion of new economic value over the next decade. That’s not a small number – $7 trillion is bigger than the third largest economy in the world, which is currently Japan.

To be fair, the economic effects of AI do not seem likely to be felt immediately or perhaps as greatly as the enthusiasm suggests. And the economy may need to confront swaths of lost jobs in the process, which can disrupt the labor market and dent consumer spending. The upshot, however, is that historically automation and other technological breakthroughs have created far more jobs than they’ve destroyed. A vast majority of long-term employment growth has come from the emergence of new occupations following technological innovation. The combination of drastic savings in labor costs, new job creation, and productivity gains can raise the prospect of economic growth—and profit growth—significantly. Investors seem to be buying into this possibility now.

The second tailwind for Technology in 2023 has been the interest rate cycle. As readers are aware, the Federal Reserve raised the benchmark fed funds rate from near zero to over 5% in the span of a year, which arguably hurt growth stocks the most. Since higher rates discount the value of future profits, investors tend to favor companies with stable earnings (value stocks) versus ones with high-profit potential (growth) in rising interest rate environments. That’s what we saw in 2022.

But that headwind shifted in 2023. In addition to enthusiasm for AI, we think Technology stocks have been outperforming this year because of the expected peak in the interest rate cycle. Inflation has been locked in a downtrend, and the Fed now expects to raise rates only one or two more times before a long pause. If investors feel as though they know where interest rates will peak—and there’s a sense that rates are more likely to fall than rise in the medium term—it only adds to the willingness to shift back into growth/technology stocks, in our view.

The Potential Headwind No One is Talking About

In a word: taxes.

For as long as major technology companies have been growing their profits, users, and expanding services around the world, they’ve been able to concentrate their earnings in home countries or countries with attractive tax rates. That could be changing very soon.

The old tax rules were written in an era where multinational corporations needed physical presence, i.e., production and sales, in a country to earn profits there. A company would likely need to set up a factory or a store to reach customers in a foreign market. Taxing those earnings and operations was fairly straightforward for foreign governments.

Not so with major technology companies, which often offer services in digital format only.

Governments around the world, particularly in Europe, have grown frustrated watching technology companies’ profits soar from digital services while tax revenues haven’t budged. Some governments began to introduce their own taxes, largely in an effort to bring the U.S. to the table to overhaul the rules.

That brings us to early July 2023, when tax officials from 143 jurisdictions have been working to ink a deal that would create a new tax structure for approximately 100 of the world’s biggest companies, mostly in technology but also in other industries like pharmaceuticals. All told, the compromise seeks to reallocate the taxation of approximately $200 billion in corporate profits around the world.

The headwind for technology companies does not seem to be the taxes themselves, which would largely amount to reallocation of where the tax money flows. The risk is in a deal not being reached at all, which may result in governments around the world imposing their own levies – known as Digital Services Taxes – which can create a maze of new tax laws and obligations that technology companies must adhere to. And that’s the last thing these companies want.

Bottom Line for Investors

The previously determined timeline to reach an agreement was early 2023, which we have clearly crossed over. The countries involved appear to be aligning on many points, but some notable holdouts include Canada and Russia. Getting them over the line could be a challenge.

Failure to reach a deal could neutralize the brisk tailwinds Technology companies are currently feeling from the promise of AI and peaking interest rates, especially if the end result is a web of individual country taxes that crimp earnings. Investors should keep their eye on this story – big news should arrive later this summer.

Most investors can get where they need to go over the long term by owning a diversified portfolio of stocks and/or ETFs. Positioning a portfolio across sector, style, size, and country will almost always provide exposure to the best performing areas of the market while minimizing the impact of the weak performing areas of the market. Volatility gets smoothed out over time, and an investor can earn attractive equity-like annualized returns. It doesn’t have to be more complicated than that, and investors don’t need a huge win in a single stock or IPO or SPAC to get there.

In fact, “diversify your portfolio” is one the most basic pieces of investing advice. Sadly, in our experience many investors still put all (or most) of their eggs in one basket.

At Zacks Advantage, we strive to help every investor properly allocate their assets. In fact, we’ve put together a helpful guide to help you understand the basics of portfolio diversification, including:

- 4 myths of a properly diversified portfolio

- Why the average investor’s returns trail almost every other investment category

- How to create a truly well-diversified portfolio

Get our free guide, Is Your Investment Portfolio Actually Well-Diversified?,4 to learn how to create a truly diversified portfolio.

*This rating was awarded by The Robo Report on 7/1/2023 in respect of the period 4/1/2023 to 6/30/2023. We do not compensate The Robo Report to obtain this rating. However, we pay compensation to the Robo Report to use their logo in connection with advertising this rating.

© 2023 Zacks Advantage | Privacy Policy | Unsubscribe

1 Wall Street Journal. July 12, 2023.

2 Zacks Investment Management may amend or rescind the Is Your Investment Portfolio Actually Well-Diversified? guide offer for any reason and at Zacks Investment Management’s discretion.

4 Zacks Investment Management may amend or rescind the Is Your Investment Portfolio Actually Well-Diversified? guide offer for any reason and at Zacks Investment Management’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Robo investments are subject to some unique risks, including, but not limited to, the fact that investment decisions are made by algorithms based on investors’ answers to questions, there is a lack of human involvement, and there is the possibility that the software may not always perform exactly as intended or disclosed. Such investment programs are only suitable for investors who can bear the risk of a complete loss of their investments.

The S&P GSCI is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The index is designed to be investable by including the most liquid commodity futures, and provides diversification with low correlations to other asset classes. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. Index composition is reviewed on an annual basis in December. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Zacks Investment Management 10 S. Riverside Plaza, Suite 1600 Chicago IL 60606-3830

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.