How Does the Current Tech Selloff Compare to the Dot-Com Bubble?

June 30th, 2022 | Posted in Investing, technologyIs the Technology-Led Selloff Another Bubble Bursting?

Pronounced market volatility during the week of June 13 caused broad U.S. stocks (S&P 500) to post their biggest weekly decline in two years. For the June declines and 2022 as a whole, technology stocks have led on the way down. In April, the tech-heavy Nasdaq Composite index delivered its worst monthly performance in over a decade.1

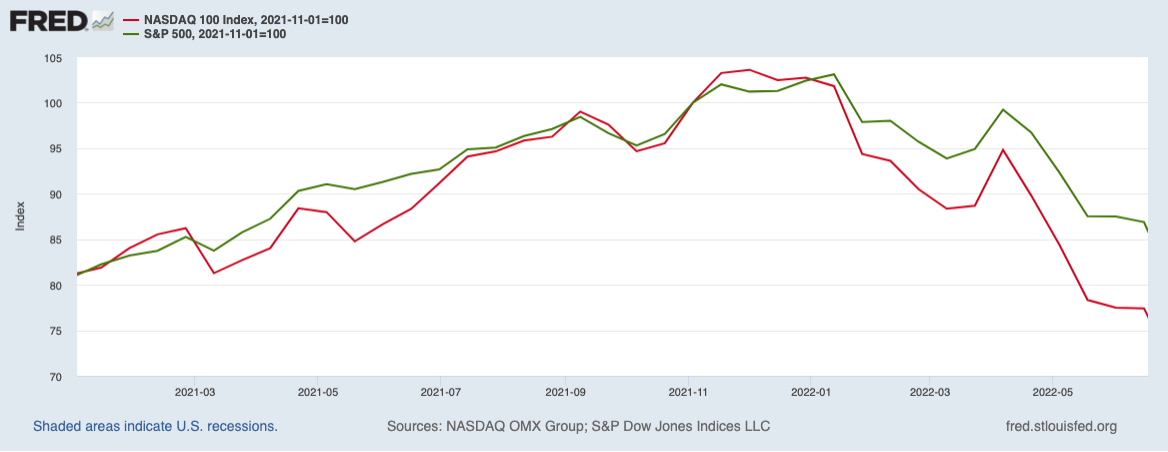

As readers can see in the chart below, the S&P 500 (green line) and the Nasdaq 100 (red line) tracked pretty closely as gains were being posted during 2021. But since the selloff took hold at the turn of the year, the Nasdaq has fallen harder and faster.2

Are Robo Advisors the Next Generation For Investment Management?

Robo advisors have made a splash by helping to streamline the investing process and possibly saving investors money. But can they replace the active management and personal attention of a traditional wealth manager? Our free Revolutionize Your Retirement guide takes a look at these important issues and more, providing our insights that may be able to help you make better investing choices. You’ll get our thoughts on:

- The Impact of Fees on Investments

- Technological Advantages including Rebalancing and Tax Loss Harvesting

- Combining Robo Technology with Active Management

Download your copy of Revolutionize Your Retirement.4

Investors have indiscriminately sold technology shares, with sharp declines seen in categories ranging from software to semiconductors, to social media and hardware. Trillions of dollars in value have been lopped off.

So, what are the driving forces behind technology’s leadership on the downside? We’ve got three ideas.

- A Sanity Check on High Valuations – in the year and a half or so following the 2020 pandemic-fueled bear market, technology stocks saw massive inflows. The market experienced an unprecedented liquidity event, with trillions of new dollars sloshing around. Since technology companies were ushering in a new era for the economy of remote work and ‘digital everything,’ they were the companies seeing the biggest increases in earnings growth. In many cases, investors bid up valuations to well over 100 times earnings, much like we saw in the 2000 technology bubble.To be fair, we do not think the 2000 technology bubble is a good comparison for the selling pressure we’re seeing now. The key difference is that companies today are delivering strong earnings and cash flows, whereas many of the dotcoms did not. The issue today is that many of these digital darlings are unable to maintain the same level of earnings growth that they delivered in 2020 and 2021, and investors are reckoning with the fact that many of them may be overpriced. This brings us to point #2.

- Earnings Moderation – Q1 2022 earnings reports led to many disappointments in the tech sector, and investors shifted quickly into risk-off mode. Amazon, for instance, reported its first quarterly earnings decline in seven years, which it accounted to higher inflation pressures and supply-chain problems. Apple shares declined when it warned that sales in China would likely suffer because of lockdowns and Covid-19 restrictions still happening there. Netflix reported in Q1 that it lost subscribers, which sent shares tumbling.Many stories like this exist, and since technology companies are a significant portion of the S&P 500, meaningful declines in technology will drag down the overall index. The upshot for investors here is that the market’s reset has brought quality companies back down to levels that are more reasonable relative to expected earnings in 2022 and beyond. In other words, technology stocks today look far better than they did at the beginning of the year.

- Higher Interest Rates – Finally, rising interest rates are arguably having an impact on technology shares. As the Federal Reserve sets off on its interest rate hike campaign, yields on the 10-year and 30-year U.S. Treasury bonds have been climbing steadily. Higher interest rates not only give investors another option for where to invest capital, but they also reduce the premium investors are willing to pay for future growth. This leads to multiple compression in the markets, and since technology stocks largely have the highest multiples of any category of stocks, they have been the primary targets, in our view.

Is the Outlook for the Technology Sector Bearish from Here?

As we mentioned in point #2, we think technology stocks look better today than they did at the beginning of the year. Strong technology companies still have a good path for growing earnings in the years ahead. The ongoing digitization of the economy, for instance, is not likely to be influenced by the path of inflation and interest rates. With hybrid work as the new normal, technology products are likely to be in higher demand in the future, not lower.

As another example, the migration to cloud computing is almost universally requisite for individuals and organizations in today’s economy, particularly as work becomes hybrid, networks have gone mobile, and memory storage grows cheaper. ‘Digital everything’ has also significantly expanded demand for cybersecurity products and services, which does not appear likely to abate any time soon. These trends all benefit technology stocks.

In the 1999-2000 technology bubble, many companies had little more than a business plan and no earnings, which looks vastly different from the environment we see today. The businesses leading the charge in technology not only have strong business models, but they are also generating attractive levels of cash flow and growth. Investors may have been paying too much for that growth in 2021, but with the selloff, the Nasdaq is not trading at levels not seen since 2020. We think this could present a good long-term buying opportunity for investors.

Today, innovative technology is changing the investment landscape quickly, including making investing for retirement potentially less complicated and more effective. Zacks Advantage is at the forefront of these developments with innovative investment solutions—including retirement investment solutions—using new financial technologies. We now offer an actively managed robo advisor that:

- Invests exclusively with ETFs

- Uses technology to recommend the appropriate mix of equities and bond ETFs to help achieve your investing goal and specific risk tolerance.

- Lowers fees and expenses

Our free Revolutionize Your Retirement guide5 provides investing insight that can help you determine whether technology-enhanced investing is right for you.

2 Wall Street Journal. April 29, 2022.

3 Fred Economic Data. June 22, 2022.

4 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

5 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.