What Does a Strong U.S. Dollar Mean for the Markets?

June 17th, 2022 | Posted in InvestingA strong dollar is great for U.S. consumers, but not a reliable indicator for investors.

The U.S. dollar has spent most of 2022 strengthening. Through the end of May, the U.S. Dollar Index – which tracks the dollar against a basket of developed foreign currencies – was up 6% year-to-date and is up over 12% in the past year. The dollar’s rally corresponds with a sell-off of other major currencies like the euro, the British pound, and the Japanese yen—putting the U.S. dollar at its highest level in 20 years.

The dollar’s strength is not happenstance, of course. A country’s currency tends to strengthen when its economic prospects are strong relative to other countries. In the current environment, Europe’s economy is more vulnerable to shocks related to the Russia-Ukraine war, Britain is still regaining footing following strict Covid-19 lockdowns and even Brexit, and China is just emerging from months of lockdowns. The U.S. has its own set of issues particularly with high inflation, but relative to these other countries, our growth profile looks quite strong.1

The market appears to be recognizing the U.S.’s relative economic strength, but it is also true that investors and asset managers tend to buy currencies in places where the central bank is raising rates to try and cool an economy. Other global central banks are starting to raise rates to stave off inflation, but none might be considered as aggressive currently as the Federal Reserve.

Positioning Your Investments for a Volatile Market.

“Don’t put all your eggs in one basket.” It’s a classic proverb, and for good reasons. Diversifying your portfolio is one the most basic pieces of investing advice—but unfortunately, it’s also advice that too many investors ignore.

Zacks Advantage would like to help you ensure that your investments are properly diversified. That’s why we’re offering our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

Act now to get the basics of diversification, including:

- Why the average investor’s returns lag behind almost every investment category

- 4 myths of a diversified portfolio

- How to create a truly well-diversified portfolio

Learn more with our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

Given our expectation for better-than-expected economic growth in 2022, coupled with the Federal Reserve’s interest rate hike campaign expected to last all year, we see the dollar maintaining strength and perhaps even adding more from here. So what does that mean for consumers, markets, and investors?

On the consumer front, a strong dollar gives Americans more spending power, particularly when buying imported goods. Traveling abroad may also be a good idea for those who can afford to do so – the dollar should go further now than it has in years past. Buying a beer in Germany or sushi in Japan costs less in dollar terms today than it has in previous years.

The opposite is also true, however, which tends to impact foreign consumers and domestic U.S. businesses that sell goods and services abroad. A stronger dollar means foreigners get fewer greenbacks for every unit of their local currency, which means less money to spend on hotels, restaurants, and stores. For big businesses in the U.S., a stronger dollar is generally a negative, since it weakens the value of international sales. Two high-profile examples that have been cited frequently in the financial news are Microsoft and Salesforce.

In their Q1 2022 earnings report, Microsoft said that the stronger dollar reduced revenue by $302 million and cut earnings per share by $0.03. Salesforce also issued a warning that a stronger dollar is expected to reduce its full-year sales by $600 million, which seems substantial until you realize that Salesforce’s last year’s foreign income registered at $36.1 billion.3 Nevertheless, investors should consider that a stronger dollar could hurt U.S. multinationals, while it also may help small- and mid-cap U.S. companies that generate more sales domestically.

Finally, there is the question of how a stronger U.S. dollar may impact equity markets. History may be the best guide.

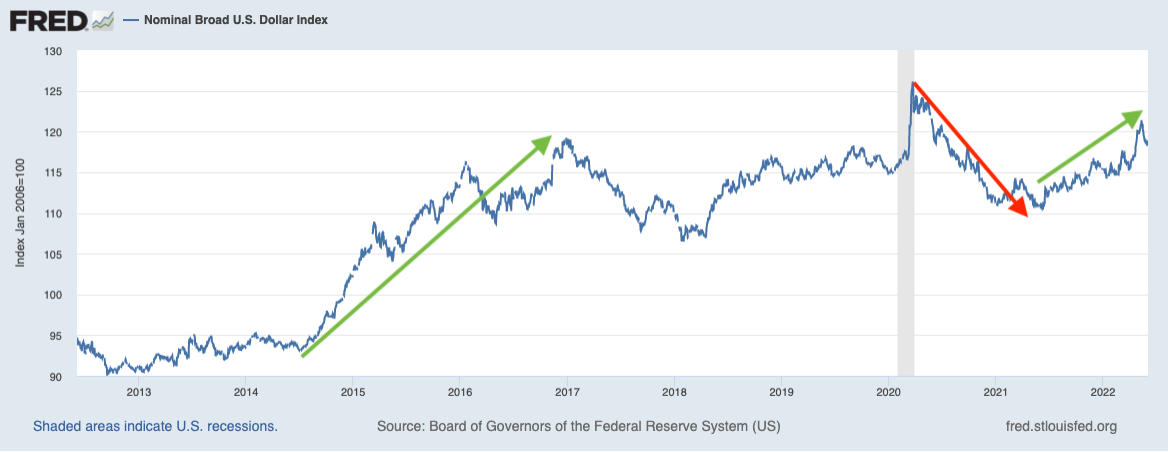

The chart below takes a look at the nominal broad U.S. dollar index. The green arrows on the chart signify times when the U.S. dollar was strengthening, while the red arrows show periods of dollar weakening. As you can see, the U.S. dollar routinely shifts from periods of strengthening to weakening, and back again.

There are several notable periods, but the first to highlight is the dollar surge from the summer of 2014 to a peak in January 2017. Specifically, from July 2014 to December 2016 the U.S. dollar strengthened by 21% – a significant jump. Similar to the current environment, the dollar was strengthening in 2014 because the Fed was unwinding its post-Great Recession QE program, which eventually gave way to interest rate increases beginning in December 2015. Here’s what the S&P 500 did over the same period:

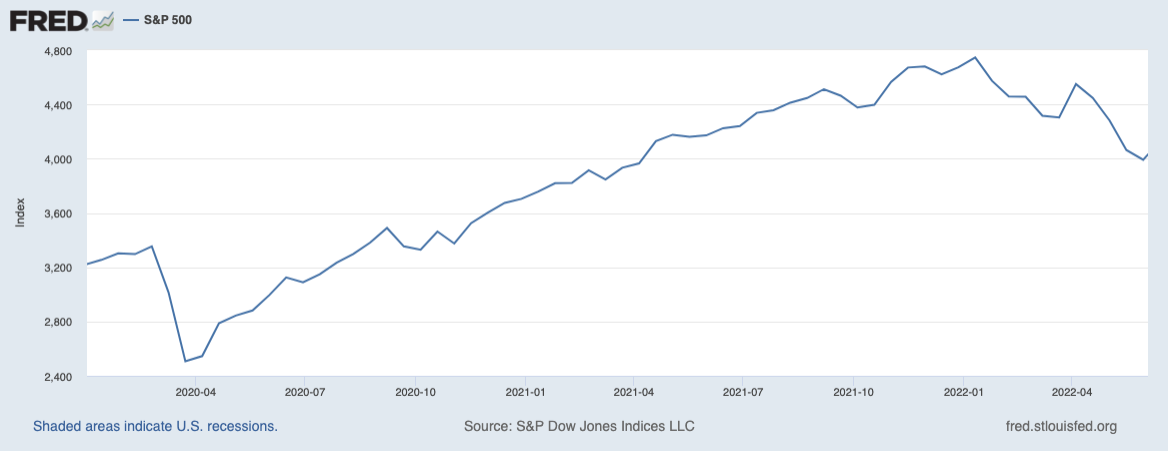

The S&P 500 from July 2014 to December 2016

As you can see, the S&P 500 endured a choppy period and moved only slightly higher, but there was another key factor in play besides Fed tightening and a stronger dollar: U.S. corporate earnings (as measured by year-over-year earnings per share growth) were down -11% in 2015. As the Fed was tightening and the dollar was strengthening, it was a weak year for profits in what we now know was a mid-cycle pause. Earnings strength in 2022 appears to be in far better shape than in 2015, though there are some signs that the pace of growth may be moderating.

The two other periods for analysis are the dollar’s weakening from March 2020 through June 2021 and the dollar’s strengthening from June 2021 to the present. Apart from the current market correction that we attribute to uncertainty over Fed policy and China lockdowns, the stock market has moved higher whether the dollar was strengthening or weakening. In our view, history shows the stock market does not ultimately have a preference on which way the dollar moves.

Bottom Line for Investors

The relative strength or weakness of the dollar is not a reliable indicator for investors, in our view. Knowing the direction of the dollar won’t do a very good job of helping you measure the strength of the US or global economy, and it certainly isn’t a powerful forecasting tool for the direction of stocks.

The dollar matters for consumption patterns and some elements of multinationals’ earnings profiles, but what matters more to stocks are actual corporate earnings results and shifting expectations around future earnings and interest rates. If corporate earnings, inflation trends, and interest rate policy all register at better-than-expected levels over the next quarter or two, then we do not think it will matter whether the dollar is strengthening or weakening. Stocks can do well in either scenario.

Most investors can get where they need to go over the long term by owning a diversified portfolio of stocks and/or ETFs. In fact, “diversify your portfolio” is one the most basic pieces of investing advice. Sadly, in our experience many investors still put all (or most) of their eggs in one basket.

At Zacks Advantage, we strive to help every investor properly allocate their assets. In fact, we’ve put together a helpful guide to help you understand the basics of portfolio diversification, including:

- 4 myths of a properly diversified portfolio

- Why the average investor’s returns trail almost every other investment category

- How to create a truly well-diversified portfolio

Get our free guide, Is Your Investment Portfolio Actually Well-Diversified?,7 to learn how to create a truly diversified portfolio.

1Wall Street Journal. June 5, 2022.

2Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

3Wall Street Journal. June 2, 2022.

4Fred Economic Data. June 6, 2022.

5Fred Economic Data. June 7, 2022.

6Fred Economic Data. June 6, 2022.

7Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.