Investment Themes for Artificial Intelligence (AI)

December 8th, 2023 | Posted in Investing“Themes” for Investing in Artificial Intelligence

The race to develop and deploy Artificial Intelligence (AI) tools is on.

According to JPMorgan data, US and global private investment in AI totaled $53 billion and $94 billion, respectively, in 2021. This level of investment marked a more than fivefold increase in real terms compared to the five years prior, and it also came before the release of Chat GPT.

Business investment for new AI computing data centers has soared since. By some estimates, business investment (capex) could reach $1 trillion in the space within the next 10 years. If an investment approach is ever about ‘following the money,’ AI is where it’s going.1

The big question for investors is, where will new AI investment dollars flow?

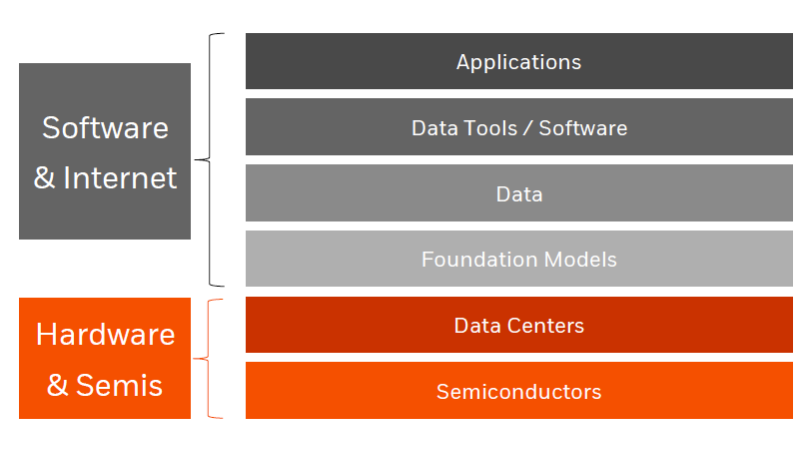

The future of AI should be thought of in two ways. First, what infrastructure is needed to build and power all of the AI tools? And second, what new businesses and systems will emerge because of AI, and who will lead this new future of business?

Starting with the first point, infrastructure, investors should focus on the “tech stack” needed to power AI, with a greater emphasis on specific types of semiconductors, supercomputers, data centers, and cloud computing services. Companies will also need to invest in infrastructure for AI training (teaching AI how to work for and within your business), increasingly advanced models, novel approaches for managing data, and new applications for humans to leverage AI systems.

Are Your Investments Really as Diversified as They Should Be?

“Don’t put all your eggs in one basket.” It’s a classic proverb, and for good reasons. Diversifying your portfolio is one the most basic pieces of investing advice—but unfortunately, it’s also advice that too many investors ignore.

Zacks Advantage would like to help you ensure that your investments are properly diversified so that you can avoid the risks of over-concentration in any particular asset class. That’s why we’re offering our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

Act now to get the basics of diversification, including:

- Why the average investor’s returns lag behind almost every investment category

- 4 myths of a diversified portfolio

- How to create a truly well-diversified portfolio

Learn more with our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

The New “Tech Stack” for Generative AI

Digging in more specifically to where billions of new dollars will need to be invested, we find four distinct categories:

- AI servers – demand for AI servers has been greater in 2023 than anyone expected, as there’s now an understanding of the compute intensity required by sophisticated AI models. Major stakeholders in the AI race – along with startups – need NVIDIA’s GPUs and the servers they accelerate. But servers require much more than GPUs, which means suppliers of CPUs, networking components, power supply, cooling systems, storage, and memory chips also stand to benefit from rapidly increasing demand.

- Memory – AI servers require far more memory and storage capacity than traditional servers, which implies that the proliferation of generative AI will mean exponential demand for memory. According to Blackrock, “a major memory chip producer predicted that 2025 will be a record year for sales on increased volume and recovery of prices (memory is currently in a cyclical downturn).” Since advances in processing speed have outpaced increases in memory bandwidth, there is rising market demand for ‘high-bandwidth memory,’ or HBM.

- Electronic Design Automation (EDA) – semiconductors are notoriously complex to design and make, and there is a notable shortage of skilled workers available. EDA is a new software technology that allows chip designers to simulate and design chips virtually, which not only saves on cost but also opens new doors for innovation. According to Blackrock, “a leading provider of EDA tools expressed confidence that AI will funnel new types of customers to EDA and stated that, for the first time in history, software is outpacing hardware.”

- Accelerated Computing – according to NVIDIA CEO Jensen Huang, “If you’re not using accelerated computing, you’re just burning power, wasting money.” Huang likened general-purpose computing as like having a workforce with no specialist. With accelerated computing, Huang says that over the last 10 years they have “reduced the cost of computing by nearly a million times….. the next 10 years, we’re going to be another million times.”

The second area of focus comes in two forms:

- Productivity Enhancement, New Services, Lower Costs – enterprises are likely to use generative AI to eliminate redundancies, drive productivity higher, reduce operational expenses, grow without hiring, and deliver new services. Together, these improvements can all drive earnings higher.

- Emergence of New Companies – there will almost certainly be the emergence of new companies that were never previously possible, much like the Ubers and TikToks of the world—which came into existence only after the iPhone did.

Bottom Line for Investors

In short, the investment opportunities with generative AI could come in the form of infrastructure, identifying companies and sectors that produce semiconductors, silicon, AI servers, memory, and all of the other infrastructure elements that are needed to power generative AI. The second opportunity is less knowable since many of the new businesses and systems that come into existence cannot be predicted. There will be winners and losers, so it will be important to approach the sector with patience and diligence.

Most investors can get where they need to go over the long term by owning a diversified portfolio of stocks and/or ETFs. In fact, “diversify your portfolio” is one the most basic pieces of investing advice. Sadly, in our experience many investors still put all (or most) of their eggs in one basket.

At Zacks Advantage, we strive to help every investor properly allocate their assets. In fact, we’ve put together a helpful guide to help you understand the basics of portfolio diversification, including:

- 4 myths of a properly diversified portfolio

- Why the average investor’s returns trail almost every other investment category

- How to create a truly well-diversified portfolio

Get our free guide, Is Your Investment Portfolio Actually Well-Diversified?, 4 to learn how to create a truly diversified portfolio.

© 2023 Zacks Advantage | Privacy Policy | Unsubscribe

2 Zacks Investment Management may amend or rescind the Is Your Investment Portfolio Actually Well-Diversified? guide offer for any reason and at Zacks Investment Management’s discretion.

3 Black Rock. Expert Insight. 2023.

4 Zacks Investment Management may amend or rescind the Is Your Investment Portfolio Actually Well-Diversified? guide offer for any reason and at Zacks Investment Management’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Robo investments are subject to some unique risks, including, but not limited to, the fact that investment decisions are made by algorithms based on investors’ answers to questions, there is a lack of human involvement, and there is the possibility that the software may not always perform exactly as intended or disclosed. Such investment programs are only suitable for investors who can bear the risk of a complete loss of their investments.

The S&P GSCI is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The index is designed to be investable by including the most liquid commodity futures, and provides diversification with low correlations to other asset classes. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. Index composition is reviewed on an annual basis in December. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Zacks Investment Management 10 S. Riverside Plaza, Suite 1600 Chicago IL 60606-3830

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.