Will AI and Tech Continue To Drive Markets In 2024?

February 14th, 2024 | Posted in InvestingWill Technology Stocks and AI Enthusiasm Continue to Propel Markets?

The best-performing sectors in 2023 were Technology (+57.8%) and Communications Services (+55.8%), the latter of which includes companies like Google, Meta, and Netflix. But the real story in 2023 was of the “Magnificent Seven” stocks, which drove a lion’s share of the stock market’s full-year returns based largely on enthusiasm for generative AI technology.

According to an analysis conducted by the Carlyle Group, there were roughly 40 AI-related stocks in the S&P 500 that all experienced strong returns in 2023. Without them, the S&P 500 would have risen about half of much as it did last year.1

This begs the question: can this AI-driven enthusiasm continue, and is there more runway for technology stocks to bolster markets again in 2024?

The best way to address this question, in our view, is to focus on earnings. Let’s start with the Magnificent Seven stocks, which swallowed headlines last year. They are Apple, Google, Microsoft, Amazon.com, Meta Platforms, Tesla, and Nvidia. Many investors viewed the wild outperformance of these names as a sign of investor euphoria and/or the possibility of a bubble forming. But this characterization may be somewhat unfair—the Magnificent Seven arguably have the strongest balance sheets in the world, and they all generate envious levels of free cash flow, have above-average profit margins, and delivered earnings growth of 33% in 2023 compared to -5% for the rest of the S&P 500.

A Better Way Forward for Passive Investors

Passive investing using ETFs has become popular, allowing virtually every investor to participate in the stock market with an ETF index fund that tracks the S&P 500. Unfortunately, these funds make it difficult to beat the market—because an index fund essentially is the market.

Zacks Advantage offers a better way forward: We have always been committed to a research-driven investment process, and we have refined our active investment experience to optimize the passive investment realm. Our actively managed robo advisor offers:

- Targeted asset allocation

- Automatic diversification

- Built-in discipline

- Simplified investing – with low fees!

Learn more with our free guide, A Better Way Forward: Actively Managing Passive Index Funds. 2

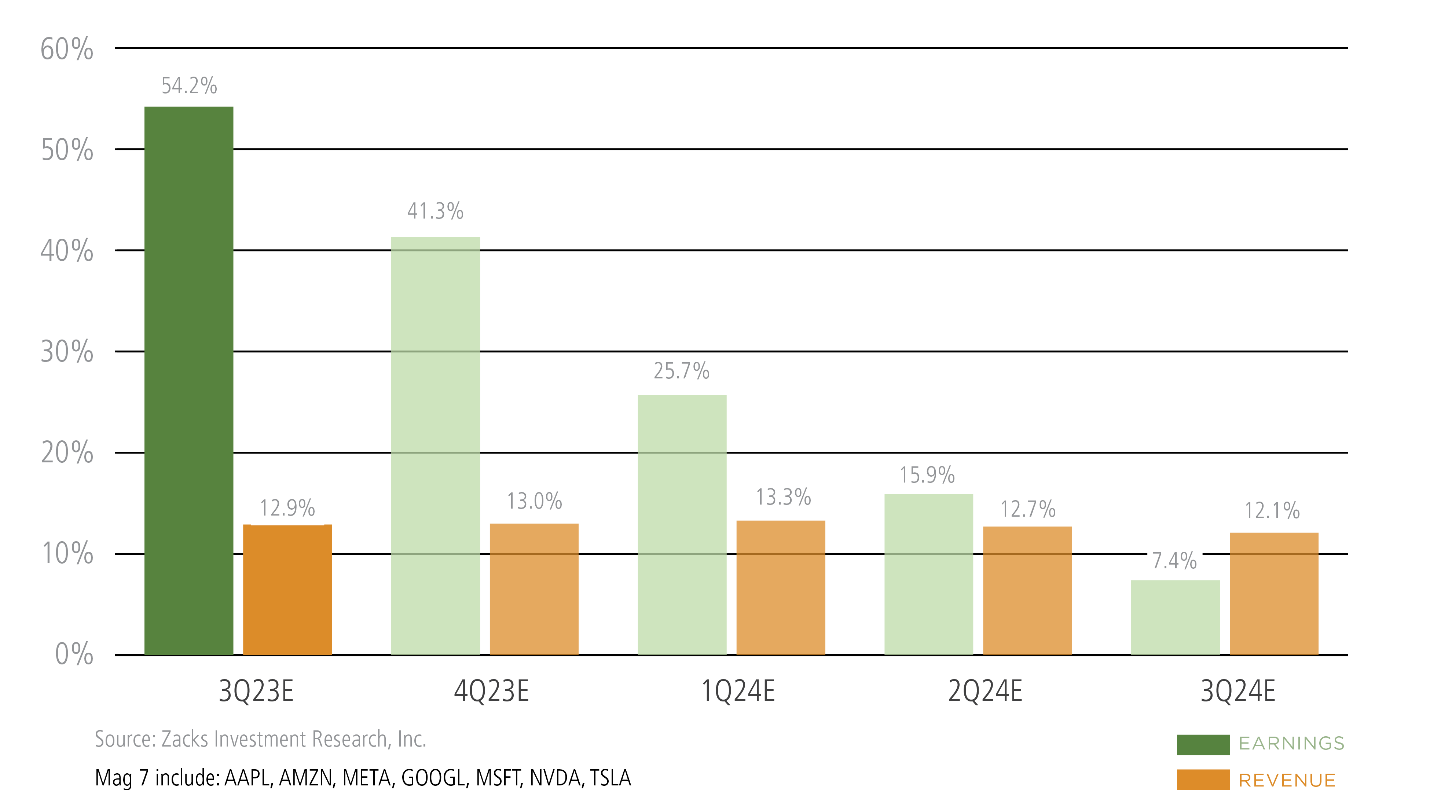

In the fourth quarter of 2023, for instance, earnings for the Magnificent Seven are expected to be up +41.3% from the same period last year on +13% higher revenues, which would follow the group’s +54.2% higher earnings on +12.9% higher revenues in 2023 Q3. Simply put, these are outstanding earnings numbers.

The Magnificent 7: Quarterly Earnings and Revenue Growth Rate (YoY)

To be fair, investors may be paying too high of a premium for these strong earnings. But the Magnificent Seven are, at the very least, giving investors a lot of reasons to own them, particularly in the realm of elevated free cash flow and numerous competitive advantages. During the late 1990s technology stock swoon, many companies didn’t have proven business models or even any earnings at all.

Beyond the Magnificent Seven, the earnings outlook for technology stocks is also looking brighter. In early 2022, we saw many sectors, especially technology, downgrading earnings estimates and many engaged in layoffs to ‘get leaner’ following the post-pandemic hiring glut. For the Tech sector as a whole, as of February 1, we have Q4 2023 earnings results for 46.8% of the sector’s market capitalization in the S&P 500. Total earnings for these Tech companies are up +19.3% from the same period last year on +6.6% higher revenues, with 82.1% beating EPS estimates and 75% beating revenue estimates. The Q4 earnings and revenue growth rates for these Tech companies are notably tracking higher than what we have seen from these companies in other recent periods.

Again, all good signs.

Bottom Line for Investors

There is plenty of hype behind the promise of generative AI, and investors may be wary of ‘hitching your wagon’ to technology optimism. Many remember the late 1990s bubble bursting, and there have been recent technological innovations—like robotics, EVs, virtual reality, and 3-D printing—that have not panned out as many hoped.

But the good news here is on two fronts. First, technology companies are generating attractive earnings and free cash flow, and businesses are increasingly adopting AI tools in efforts to increase productivity. Earnings estimates reflect as much. Second, the outperformance of the Magnificent Seven last year has made the stock market look expensive—with a forward P/E of 19.5x—which we think masks some unique opportunities in the year ahead. If you look at the forward P/E multiple of the equal-weighted S&P 500—which gives equal weighting to the Magnificent Seven and all other 493 stocks—it is evident the stock market is not uniformly stretched from this vantage, the forward P/E falls to a more reasonable 16x.

Additionally, when we look beyond US mega-caps, earnings yields look reasonable relative to history, and in many areas, valuations have improved relative to last year. We view this as a wide opportunity set, particularly given our belief that positive operating leverage and productivity growth from artificial intelligence should lead to margin expansion across many industries in the coming years.

In recent years, passive investing has become a popular approach, allowing virtually every investor to participate in the stock market with an ETF index fund that tracks the S&P 500.

However, a purely passive approach cannot beat the market (because it basically is the market). That’s why Zacks Advantage offers an actively managed robo advisor that:

- Invests exclusively with ETFs

- Uses technology to recommend the appropriate mix of equities and bond ETFs to help achieve your investing goal and specific risk tolerance

- Lowers fees and expenses

Get our free guide, A Better Way Forward: Actively Managing Passive Index Funds, to learn the 4 issues that can hold back returns for passive investors, and how Zacks Advantage can help you overcome them.

© 2024 Zacks Advantage | Privacy Policy | Unsubscribe

1 Wall Street Journal. January 4, 2024.

2 Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

4 Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Robo investments are subject to some unique risks, including, but not limited to, the fact that investment decisions are made by algorithms based on investors’ answers to questions, there is a lack of human involvement, and there is the possibility that the software may not always perform exactly as intended or disclosed. Such investment programs are only suitable for investors who can bear the risk of a complete loss of their investments.

The S&P GSCI is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The index is designed to be investable by including the most liquid commodity futures, and provides diversification with low correlations to other asset classes. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. Index composition is reviewed on an annual basis in December. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Zacks Investment Management 10 S. Riverside Plaza, Suite 1600 Chicago IL 60606-3830

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.