Will Holiday Retail Sales Disappoint the Markets?

November 15th, 2021 | Posted in InvestingWill Holiday Retail Sales Disappoint the Markets?

Most readers are likely aware of the supply chain issues facing the U.S. and the world. Products are missing from the shelves, delivery times keep getting longer, and the prices of many goods and services have been moving higher. Surging demand, rising input costs, jammed ports, labor shortages, and factory closures overseas have all contributed to the problem. For holiday shoppers, it could mean fewer discounts and more out-of-stock items.1

Most readers are likely aware of the supply chain issues facing the U.S. and the world. Products are missing from the shelves, delivery times keep getting longer, and the prices of many goods and services have been moving higher. Surging demand, rising input costs, jammed ports, labor shortages, and factory closures overseas have all contributed to the problem. For holiday shoppers, it could mean fewer discounts and more out-of-stock items.1

These issues have also lasted longer than many anticipated, which begs the question: will slumping holiday sales ultimately lead to weaker-than-expected GDP growth and corporate earnings in Q4? And will the equity markets be volatile as a result?

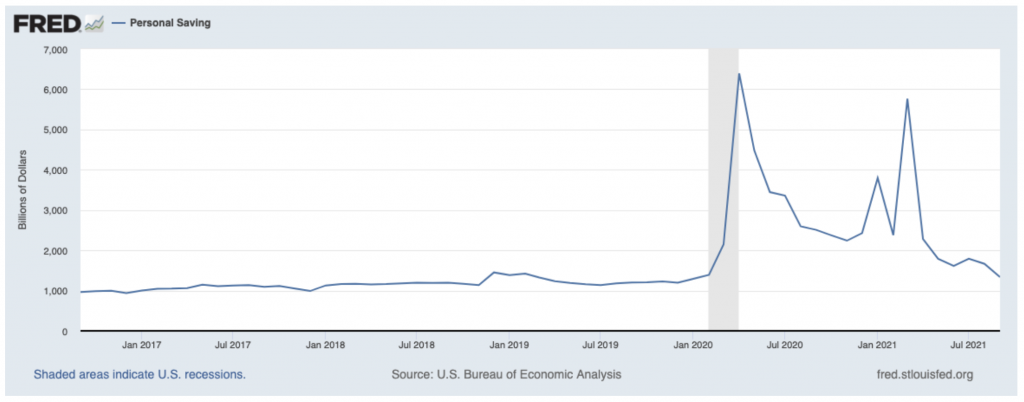

Another issue to consider in answering these questions is whether the U.S. consumer is still armed with cash to spend. Over the past several months, consumers have been spending down many of the savings accumulated via delayed spending during the pandemic, fiscal stimulus payments, or both. Personal savings have dipped close to pre-pandemic levels.

Are Robo Advisors the Next Step For Investors?

Robo advisors have made a splash by helping to streamline the investing process and possibly saving investors money. But can they replace the active management and personal attention of a traditional wealth manager? Our free Revolutionize Your Retirement guide takes a look at these important issues and more, providing our insights that may be able to help you make better investing choices. You’ll get our thoughts on:

- The Impact of Fees on Investments

- Technological Advantages including Rebalancing and Tax Loss Harvesting

- Combining Robo Technology with Active Management

Download your copy of Revolutionize Your Retirement.2

Consumers Have Been Spending Down Savings

Source: Federal Reserve Bank of St. Louis3

While the table appears set for year-over-year holiday sales to disappoint, there are two factors that may support equity markets in the near term:

- Constant coverage of supply chain and inflation issues are in effect creating a ‘wall of worry’ around spending, growth, and earnings in Q4. These concerns, while valid, are also tempering expectations – essentially lowering the bar for a positive surprise.

- Retail and spending research groups are suggesting that the negative outlook for holiday shopping is misplaced – many see sales in 2021 topping last year’s records.

Among the research groups anticipating record sales in the National Retail Federation, which recently said it expects November and December holiday sales to jump somewhere in the range of 9% to 10% from 2020. The figure given for total possible sales was nearly $1 trillion and does not even include spending at car dealerships, gas stations, and restaurants.

These sales figures, if met, would mean all-time spending records for the U.S. consumer. Then there is the matter of online or e-commerce sales, which have become a growing share of total sales and are expected to increase by up to 15% from 2020. The shift towards e-commerce was underway before the pandemic struck in March 2020, and has since been catalyzed as many consumers have eschewed the in-person shopping experience in favor of having goods shipped.

Another factor that may boost spending this year to better-than-expected levels is the current status of the pandemic. The latest wave of Delta cases weighed on economic activity in late summer and early fall, but the surge appears to be abating – at least for now – which could buoy consumer sentiment and encourage people to get back out and shop.

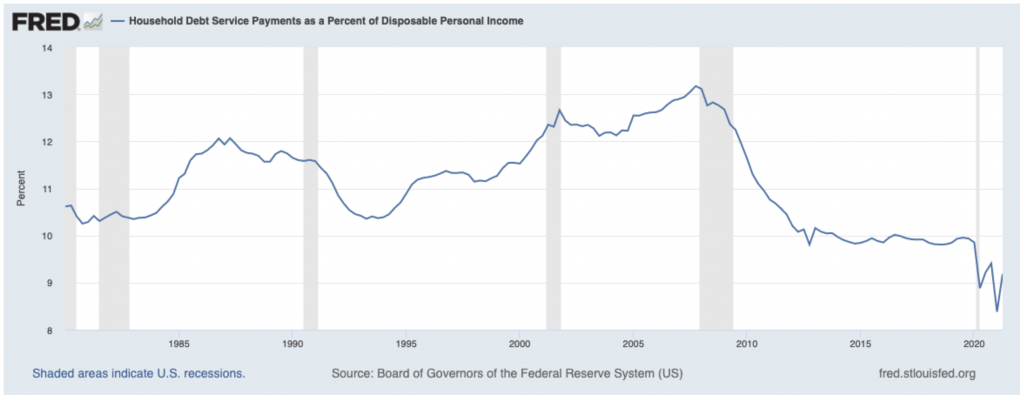

One of the questions posed at the beginning of this piece was whether the U.S. consumer was still armed with cash to spend. Though the strong uptick in personal savings has indeed been spent down over the past several months, a good portion of savings has been used to pay down debt, bringing down the percent of personal income that is devoted to debt payments (chart below). Spending less on debt means having more to spend in the economy.

Source: Federal Reserve Bank of St. Louis4

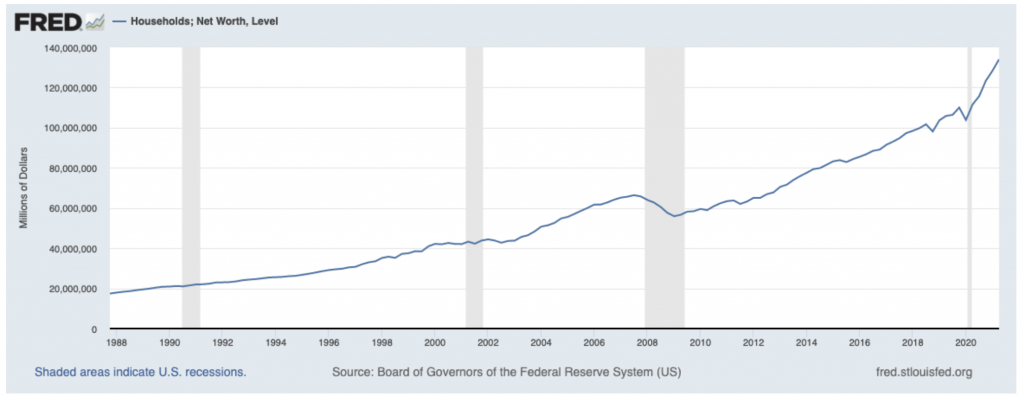

Because of a strong housing and stock market, U.S. households also have a record net worth of over $140 trillion. A strong capital position, with soaring net worth and lower household debt, should put consumers in a strong position heading into this year’s holiday shopping season.

Source: Federal Reserve Bank of St. Louis5

Bottom Line for Investors

The holiday shopping season is a useful barometer for the overall health of the U.S. economy, but it’s not a ‘make or break’ metric for whether the economy is thriving or in trouble. Retail sales only make up a small overall percentage of total consumer expenditures, which are now dominated by spending on services.

Even still, readers may encounter dire forecasts of supply chain problems and rising prices wrecking the holiday shopping season, which spells bad news for the economy and markets. We believe the opposite could be true – negative holiday sales expectations and gloomy growth and earnings forecasts could effectively create a ‘wall of worry,’ which markets love to climb. If holiday sales come in even slightly better than expected – which we believe they will – it could boost sentiment and provide upside support for markets.

Technological innovation is changing the investment landscape quickly, including making investing for retirement potentially less complicated and more effective. Zacks Advantage is at the forefront of these developments with innovative investment solutions—including retirement investment solutions—using new financial technologies. Our actively managed robo advisor:

- Invests exclusively with ETFs

- Uses technology to recommend the appropriate mix of equities and bond ETFs to help achieve your investing goal and specific risk tolerance.

- Lowers fees and expenses

Our free Revolutionize Your Retirement guide6 provides investing insight that can help you determine whether technology-enhanced investing is right for you.

2 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

3 Fred Economic Data. October 29, 2021.

4 Fred Economic Data. October 26, 2021.

5 Fred Economic Data. September 23, 2021.

6 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.