How will inflation and rising rates affect the market?

October 26th, 2021 | Posted in InvestingAre Inflation and Rising Interest Rates Going to be a Problem for Markets?

Inflation is everywhere, and there’s a possibility it may not be as ‘transitory’ as the Federal Reserve had once hoped.

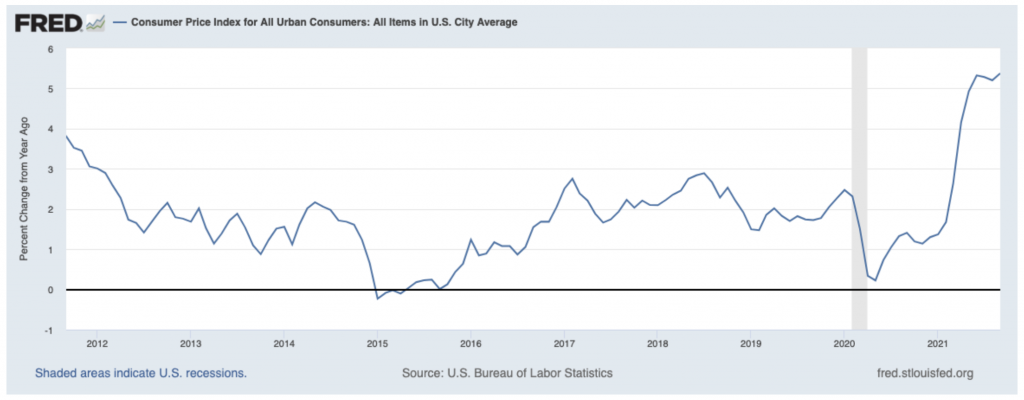

In a Labor Department report released last week, September’s consumer price index posted a 5.4% increase from a year earlier, which maintains a pace seen throughout the summer months. The core index, which excludes food and energy, was up 4% from September 2020.1 It’s plain to see from the chart below that inflation has not seen these levels in at least the last decade:

Source: Federal Reserve Bank of St. Louis2

Take an Active Approach to Passive Investing.

Passive investing (as opposed to actively trading stocks) has become a highly popular approach, as seen in the rise of index funds, ETFs, and robo advisors.

The downside of a passive approach is that it is impossible to beat the market when you’re simply investing in the market. Zacks Advantage offers a better way forward: active management of passive index funds. Our research-driven investment process offers an actively-managed robo advisor that provides:

- Targeted asset allocation

- Automatic diversification

- Built-in discipline

- Simplified investing – with low fees

Learn more about how you can benefit from our actively-managed robo advisor with our free guide, A Better Way Forward: Actively Managing Passive Index Funds.3

These are stout inflation figures, but it’s fair to point out they are being compared to a year ago, when the economy was reopening but still in the early stages of recovering from the short, steep recession fueled by a global economic shutdown. The issue there is that inflation is still relatively high even when compared to 2019, before the pandemic was a factor.

These are stout inflation figures, but it’s fair to point out they are being compared to a year ago, when the economy was reopening but still in the early stages of recovering from the short, steep recession fueled by a global economic shutdown. The issue there is that inflation is still relatively high even when compared to 2019, before the pandemic was a factor.

Labor issues and snarled supply chains are causing shortages of product components and putting price pressures on raw materials and finished goods. It currently takes about 80 days to transport goods across the Pacific Ocean, which is twice as long as pre-pandemic. Once cargo ships make it to major U.S. ports, they are often stalled there for days or even weeks. The problem is significant enough that some major U.S. retailers like Walmart, Home Depot, and Costco have resorted to chartering their own cargo ships to move goods, particularly in time for the holiday shopping season.

Supply chain constraints are combining with rising energy prices to put additional cost pressures on businesses. Crude oil prices are up over 60% this year, natural-gas prices have doubled over the last six months, and coal prices are at records.4 A key factor to watch in Q4 and beyond is whether supply chain issues and rising energy costs persist for longer-than-expected, squeezing corporate profit margins and ultimately resulting in downward earnings revisions. Corporate earnings forecasts remain very strong for now, but these are factors to watch closely.

The pandemic is partly driving bottlenecks, but the bigger factor in our view is that corporations and supply chains simply cannot keep pace with demand. The U.S. consumer has a record $142 trillion in net worth5—fueled by a rising stock market, a strong housing market, and accumulated savings over the last year and a half—and the global economy is in the midst of a rolling reopening. While there are reported shortages of all types of goods and services, there is no shortage of demand. In our view, that’s a good problem.

To the extent higher inflation drives higher interest rates, we would actually view interest rate ‘normalization’ as a healthy sign, particularly if the economy is still in growth mode. Rates are still very low in a historical context. The speed of the adjustment in rates may create temporary consternation in markets, as certain over-leveraged investors and speculators have to adjust their positioning. To the extent higher rates take excessive froth out of the market, however, we ultimately view the volatility as a good outcome.

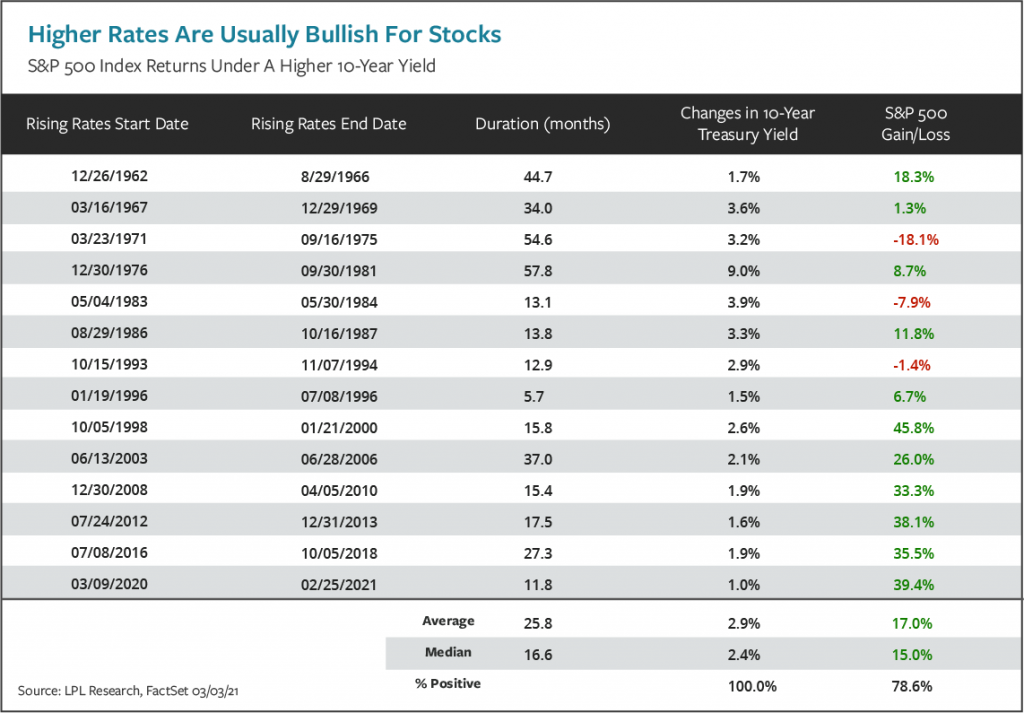

Rising bond yields may drive downside volatility in certain high valuation multiple stocks, but for stocks in general, rising rates have not necessarily been a bad omen, historically. LPL Research crunched the numbers. Over the last ~60 years, the S&P 500 rose an average of +17% during periods of rising bond yields, which lasted an average of 25.8 months.

LPL Financial6

Bottom Line for Investors

Inflation has been higher than expected and has been lasting longer than expected. In the minutes of the Fed’s September 21 and 22 meeting, there was more evidence that officials are noting this ‘sticky’ inflation, which makes the likelihood of ‘tapering’ and perhaps interest rate increases in 2022 more likely.

We do not think investors should fear this outcome. To take a bit of a contrarian view, we would welcome a Fed announcement to taper and eventually end QE purchases. Fed intervention keeps downward pressure on long-dated U.S. Treasury bond yields, which squeezes bank profits and removes incentives for more bank lending – not great for the economy. An underappreciated effect of reducing monthly purchases is lower demand for long duration Treasury bonds, which should put upward pressure on yields. The end result may be a steepening yield curve, which is generally a positive leading indicator for economic activity.

Passive investing, including the use of index funds, ETFs, and robo advisors, has opened the door to millions of new investors. But it’s important to understand that while passive investing lets you be in the market, to beat the market you must take an active approach.

Zacks Advantage offers a research-driven investment process that offers the convenience and access of passive investing in an actively-managed robo advisor. Our approach:

- Invests exclusively with ETFs

- Uses technology to recommend the appropriate mix of equities and bond ETFs to help achieve your investing goal and specific risk tolerance.

- Combines robo technology with a real (human) advisor working to ensure that your portfolio is meeting your needs

- Lowers fees and expenses

Our free guide, A Better Way Forward: Actively Managing Passive Index Funds, provides investing insight that can help you determine whether technology-enhanced investing is right for you.

1 Wall Street Journal. October 13, 2021.

2 Fred Economic Data. October 13, 2021.

3 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

4 Wall Street Journal. October 14, 2021

5 Wall Street Journal. October 13, 2021.

6 LPL Financial. March 8, 2021.

7 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.