Participate in the Market While Mitigating Risk

November 29th, 2017 | Posted in InvestingSavvy investors know that one of the best ways to maximize stock market returns over the long term is to simply stay invested. Market timing has been shown time and again to underperform a stay-invested approach.

That said, the current bull market is close to becoming the longest one ever. If you have the vast majority of your portfolio invested in stocks, a little anxiety is understandable.

That said, the current bull market is close to becoming the longest one ever. If you have the vast majority of your portfolio invested in stocks, a little anxiety is understandable.

Consider the 60/40 Approach

So if you want to keep investing, how do you reconcile this anxiety with what you know has been the historically smarter approach? A recent post on Nerdwallet cites Federal Reserve data which suggest a 60/40 split of equities/bonds might be an ideal solution. Investors still have access to the benefits of investing in the equity markets, while lessening downside risk.

“Big swings occur on a yearly basis, but the long-term trend has definitely been positive,” the article states. “If you’re willing to ride out the ups and downs, you have a better chance of capturing the markets’ long-term positive trend.”

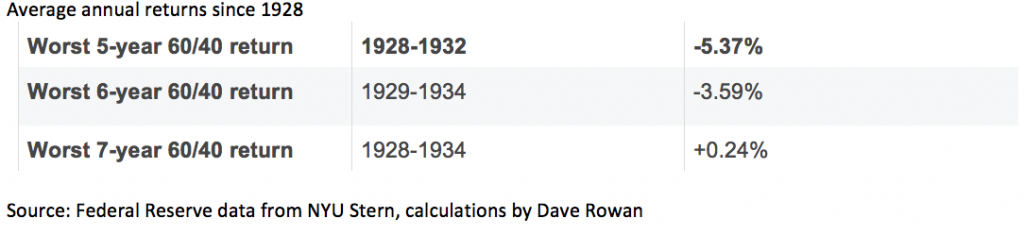

Historically, investing in a portfolio of 60% stocks/40% bonds with a minimum five-year holding period since 1926 has successfully hedged downside risk to just -5.37%. Meanwhile, such a portfolio generated an average annual return of +7.8%. And as shown below, the longer an investor stuck with the portfolio, the less downside risk they experienced.

Worst 5-, 6- and 7-year performances of a 60/40 split

A Little Correction Protection Can Go a Long Way

It’s easy to stay invested when the market is rising. But it takes fortitude to stay the course when you’re losing money, even if that loss is only on paper. If a 60/40 split encourages you to retain your market exposure, it may help you achieve better returns over the long haul versus exiting the market and then missing a rebound.

Zacks Advantage offers you the ability to adjust your mix of assets based on your goals and risk tolerance. If our software recommends a portfolio you feel doesn’t quite meets your needs, our Wealth Management Analysts can help you adjust it to your satisfaction.

So there’s no reason not to invest if you believe investing is the best way to pursue your financial objectives. As we’ve said many times, for long-term investors it doesn’t really matter when you invest, only that you invest.

Learn more about how Zacks Advantage combines the simplicity and low fees of a robo advisor with performance-focused active management. Download our Overview Guide today!

1 Source: Vanguard. https://personal.vanguard.com/us/insights/saving-investing/model-portfolio-allocations

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.